Punjab Stamp Duty Relief 2026: Massive Savings for Homebuyers as Government Slashes Rates to 1% — Deadline January 31

Published by News Desk, Garah Pravesh

Breaking Property News from Punjab: A Landmark Stamp Duty Decision

In a move that is being widely hailed as one of the most homebuyer-friendly real estate reforms in Punjab, the state government has announced substantial stamp duty relief for property buyers in cooperative housing societies, particularly benefiting residents of Mohali and adjoining urban clusters.

As per an official Punjab Government notification dated January 12, 2026, thousands of families residing in cooperative housing societies will now be able to register their properties at dramatically reduced stamp duty rates, starting from just 1%, provided registrations are completed within specified timelines.

This decision is expected to unlock long-pending registrations, provide legal ownership security to residents, boost real estate liquidity, and significantly reduce the financial burden on middle-class homebuyers.

Checkout latest Properties listings – Residential – Commercial – Industrial

At a Glance: Punjab Stamp Duty Relief Scheme 2026

Key Highlights

-

Stamp duty reduced from 8% to as low as 1%

-

Applicable to subsequent buyers of cooperative housing societies

-

Relief valid till March 31, 2026, with phased rates

-

Full exemption from SIC, PIDB, and SIDF charges

-

Nearly 5,000 to 7,000 families in 24–25 Mohali societies to benefit

-

Special protection proposed for buyers facing documentation delays

Punjab Stamp Duty Relief 2026 — Complete Details, Rates, Deadlines & Buyer Benefits

The Punjab government’s latest decision directly impacts housing cooperative societies and other cooperative bodies registered under the Punjab Cooperative Societies Act, 1961, which allot plots, flats, and residential units to their members.

For years, thousands of residents have lived in legally allotted homes but faced challenges in completing registration due to high stamp duty costs, procedural delays, and documentation bottlenecks. This new policy aims to resolve those long-standing issues decisively.

What Exactly Has the Punjab Government Announced?

The government has approved temporary but highly concessional stamp duty rates for property registrations involving buyers who purchased properties after the original allotment by cooperative societies.

Revised Stamp Duty Structure (2026)

| Registration Period | Stamp Duty Payable |

|---|---|

| Up to January 31, 2026 | 1% |

| February 1 – February 28, 2026 | 2% |

| March 1 – March 31, 2026 | 3% |

| After March 31, 2026 | Full applicable stamp duty (8% or as per prevailing rules) |

This structured timeline strongly encourages buyers to act early and complete registrations without delay.

Who Is Eligible for This Stamp Duty Relief?

This relief is not universal, but it covers a large and clearly defined category of buyers:

Eligible Beneficiaries

-

Subsequent purchasers (buyers after the original allottee)

-

Members of housing cooperative societies

-

Properties allotted under societies registered with the Punjab Cooperative Societies Act, 1961

-

Residential plots, flats, and apartments

-

Buyers completing registration within the notified timeframes

Major Beneficiary Region

According to Mohali MLA Kulwant Singh, approximately:

-

24–25 cooperative housing societies in Mohali

-

5,000 to 7,000 families currently residing in these societies

are expected to gain direct financial and legal benefits from this policy.

What Charges Are Fully Waived? A Big Financial Relief

Beyond stamp duty reduction, the Punjab government has provided complete exemption from several additional levies that typically inflate registration costs.

Fully Exempted Charges

-

SIC (Social Infrastructure Cess)

-

PIDB (Punjab Infrastructure Development Board charges)

-

SIDF (State Infrastructure Development Fund)

Still Applicable

-

Registration fee of 1% (mandatory as per existing rules)

This exemption further reduces the total cost of property registration, making legal ownership significantly more affordable.

Checkout latest Properties listings – Residential – Commercial – Industrial

Why This Decision Matters for Punjab’s Real Estate Market

This policy intervention is more than a temporary discount—it is a strategic real estate reform with far-reaching implications.

Key Market Impacts

-

Encourages formalization of property ownership

-

Clears long-pending registration backlogs

-

Improves buyer confidence

-

Enhances market liquidity

-

Boosts secondary resale transactions

-

Strengthens government revenue in the long run through compliance

For buyers, this translates into peace of mind, legal security, and substantial savings.

Protection for Buyers Facing Registration Delays

One of the most critical aspects of this announcement is the government’s buyer-protection stance.

Assurance by Mohali MLA Kulwant Singh

The MLA has committed to taking up the matter with the Punjab government to ensure:

-

Buyers who purchase stamp duty certificates and submit documents before January 31, 2026

-

But whose registrations are delayed due to unavoidable or administrative reasons

should continue to receive the 1% concessional rate, even if the actual registration date extends beyond January 31.

Special Registrars to Be Appointed if Societies Delay Documents

In cases where housing cooperative societies fail to provide mandatory documents such as:

-

NDC (No Dues Certificate)

-

NOC (No Objection Certificate)

the Punjab Cooperation Department will:

-

Appoint Special Registrars

-

Facilitate fast-track registrations

-

Prevent buyers from losing benefits due to society-level delays

This move directly addresses a long-standing grievance among cooperative society residents.

Financial Savings — Real Numbers for Buyers

Let us understand the actual monetary benefit with an example.

Example: Property Value ₹1 Crore

| Scenario | Stamp Duty |

|---|---|

| Earlier rate (8%) | ₹8,00,000 |

| New rate (1%) | ₹1,00,000 |

| Total Savings | ₹7,00,000 |

This level of savings can be redirected towards:

-

Home interiors

-

Loan prepayment

-

Additional investment

-

Emergency funds

Strategic Advice for Buyers — Act Before January 31, 2026

From a professional real estate advisory perspective, January 31, 2026 is the most critical deadline.

Why Early Registration Is Crucial

-

Lowest stamp duty rate (1%)

-

Maximum financial savings

-

Avoids documentation congestion later

-

Protects against policy reversals

Checkout latest Properties listings – Residential – Commercial – Industrial

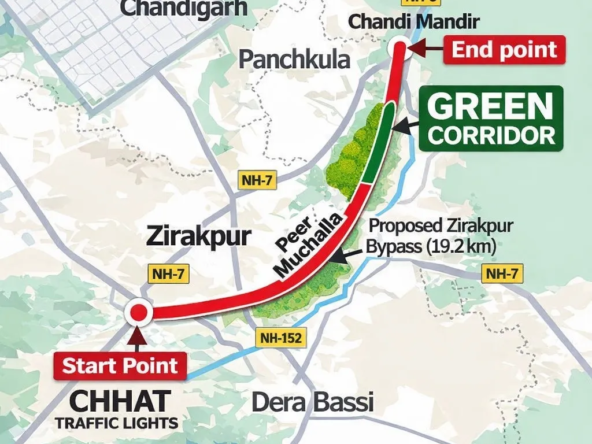

Impact on Mohali, Zirakpur & Tricity Real Estate

This decision is expected to:

-

Increase resale activity

-

Unlock frozen inventories

-

Improve legal clarity

-

Enhance capital appreciation

Mohali, being home to a large number of cooperative societies, stands to gain the most, followed closely by Zirakpur, Kharar, and New Chandigarh.

Frequently Asked Questions (FAQs)

Is this stamp duty relief applicable to new allotments?

No. The relief applies to subsequent purchasers, not original allottees.

What happens if I miss the March 31, 2026 deadline?

Full stamp duty as per existing rules will apply.

Are commercial properties included?

The notification primarily covers residential properties allotted through cooperative societies.

Is the 1% registration fee waived?

No. A 1% registration fee remains mandatory.

Can buyers get relief if societies delay documents?

Yes. The government has assured special registrars and protection for timely applicants.

Expert Insight — A Rare Policy Window

Real estate experts agree that such deep stamp duty cuts are rare and typically time-bound. Buyers who act within this window stand to gain exceptional long-term value.

Final Verdict — A Golden Opportunity for Punjab Homebuyers

The Punjab Stamp Duty Relief 2026 is not just a policy announcement—it is a once-in-a-decade opportunity for thousands of families to secure legal ownership at a fraction of earlier costs.

Those who delay risk:

-

Higher costs

-

Administrative congestion

-

Loss of financial advantage

Those who act now gain:

-

Massive savings

-

Legal certainty

-

Peace of mind

Get Expert Help Today

📞 Get best and transparent deals with Garah Pravesh — 7087949434

#PunjabStampDutyRelief #MohaliPropertyNews #PunjabRealEstate2026

#StampDuty1Percent #CooperativeHousingPunjab

#PropertyRegistrationPunjab #GarahPravesh #HomebuyerRelief